Pollution pricing is about fighting climate change in a way that is affordable for Canadians. Our system acknowledges the cost of pollution on Canadians’ communities, health, and wallets, and allows individuals and businesses to find the most efficient way to reduce their emissions. It motivates industries to become more efficient and adopt cleaner technologies, leading to innovation that reduces pollution, uses energy more efficiently, and saves money. We also know that putting a price on pollution is the best way to fight climate change – and it is working. It is estimated that pollution pricing will be responsible for approximately one third of Canada’s expected emissions reductions by 2030.

At the same time, all pollution pricing revenue is returned to Canadians. Thanks to the quarterly rebates, those who reduce emissions are better off, because their rebates become even larger than what they are paying. And because pollution pricing is revenue neutral and the top 10% of polluters in Canadians are responsible for more than a quarter of all emissions, this allows the Canada Carbon Rebate to return more to eight out of ten Canadians than they pay, as confirmed by the independent Parliamentary Budget Officer.

The revenue neutrality of pollution pricing also means that for the changes to pollution pricing in April of this year, the fuel charge and the rebate will increase proportionally, preserving the beneficial affordability impact that pollution pricing has. In 2024-2025, while the average household in Ontario will pay $869 in direct and indirect pollution pricing costs, they will get back $1,124, leaving them better off by $255. And all you need to do to receive these savings is to file your annual tax return.

Since 2019, every jurisdiction in Canada has had a price on carbon pollution. Canada’s approach gives provinces and territories the flexibility to implement the system that works best for their needs: either their own pollution pricing system, or the federal pollution pricing system. This means that the federal fuel charge applies in Alberta, Saskatchewan, Manitoba, Ontario, Newfoundland and Labrador, Nova Scotia, Prince Edward Island, Yukon, and Nunavut. British Columbia, Quebec, and the Northwest Territories have their own systems.

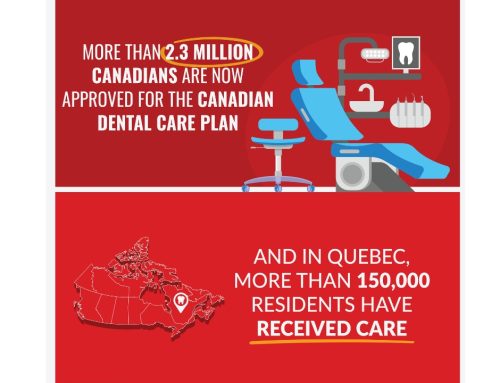

Canadians are feeling the rising cost of living, particularly through higher grocery bills, rent and gas prices, which are driven up by international conflict and natural disasters caused by climate change. That is why we are fighting for affordability through generous carbon rebates, alongside other measures like the First Home Savings Account, implementing affordable early learning and childcare, creating the Canada Dental Care Plan, introducing National Universal Pharmacare, and indexing benefits to inflation.

Overall, pricing carbon pollution is working. It motivates industries to become more efficient and adopt cleaner technologies, leading to innovative methods for reducing pollution, using energy differently, and saving money.

Our government will continue to take action to address environmental challenges, in a way that directly helps families with the cost of living while creating good and sustainable jobs.

To learn more about how carbon pricing works click here.

Leave A Comment